July 11, 2013

Our mission is to provide accurate industry knowledge, up-to-date information, forward-thinking analysis and the best business strategy recommendations to our clients.

At SID 2013 I visited LG Display’s exhibition booth and asked the booth attendants about their flexible AMOLED. Another visitor happened to be standing there looking at the flexible AMOLED too. I asked the LG booth attendants, “Does this flexible display use the color filter method?”

The LG booth people answered, “No, this demo doesn’t use a color filter.”

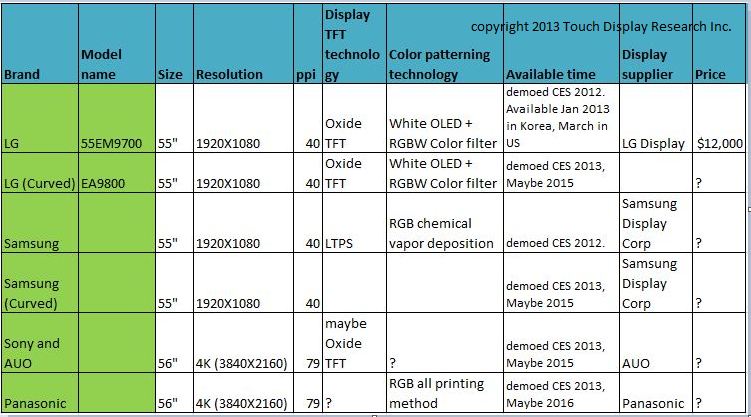

I nodded. At this point, the other visitor jumped in and said, “OLED doesn’t need a color filter, it’s not LCD.” The visitor looked like an intelligent young man, but only knew part of the technology. I explained to him, “Some OLEDs use a color filter––LG’s OLED TV uses white OLED plus a color filter.”

The young visitor looked at me with doubt, “Really? I don’t think so.” Then he started to talk to the LG booth people, “I saw your CEO gave a keynote two days ago.” The LG booth people asked, “Where?”

The young visitor said, “The keynote at the beginning of this SID.”

I came to SID 2013 on Tuesday afternoon and missed the keynote talk that morning, but I knew the keynote speaker had been Samsung Display’s CEO, not LG’s CEO. I said, “That was Samsung’s.” The LG booth people also said, “Our CEO didn’t come this time. Maybe it was Samsung’s.”

But the young visitor didn’t hear me, and kept chatting with the LG booth people.

I walked away with a bit of heartbreak and sympathy for the young visitor.

I recently saw presentation slides from a university professor. In one slide he indicated IGZO TFT was still in R&D stage. I looked at the presentation time––March 2013. I know that Sharp announced the mass production of IGZO TFT in April 2011, and finally mass produced it in April 2012. I met Sharp’s CTO in April 2012. Obviously, that professor had out-dated information and hadn’t followed Sharp’s progress in IGZO.

There are many people like that young visitor and the professor who only know part of the technology, part of the story, and unfortunately provide wrong opinions. They don’t know that AMOLED can have color filter too, they can’t tell Samsung from LG, they don’t know that Sharp has already mass-produced IGZO since 2012, but they are willing to spread wrong information.

I’m concerned about these people and the people they advise. I feel as a Ph.D. and experienced technology analyst, I have the responsibility to provide to my clients correct knowledge, up-to-date information, forward-thinking analysis, and best business strategies.