August 8, 2013

(Editor’s note: Dr. Jennifer Colegrove will be traveling to Taipei, Taiwan later this month to speak at the International Display Manufacturing Conference (IDMC) and to visit TouchTaiwan 2013.)

“I am honored to be delivering a special forum at the conference, and eager to meet Taiwan’s touch screen manufacturers and emerging display manufacturers,” said Dr. Colegrove.

Jennifer will be speaking on August 28th, 13:20-13:45 at a special forum of the IDMC conference which is in conjunction with TouchTaiwan exhibition. Contact her by email: jc@touchdisplayresearch.com

Blog:

Taiwan is one of the most active regions in touch screen manufacturing. In 2006-2007, Apple’s iPhone brought revolutionary changes to the touch screen industry. Touch panel companies at the forefront such as TPK, Wintek, Youngfast, J-Touch rode the wave and grew rapidly.

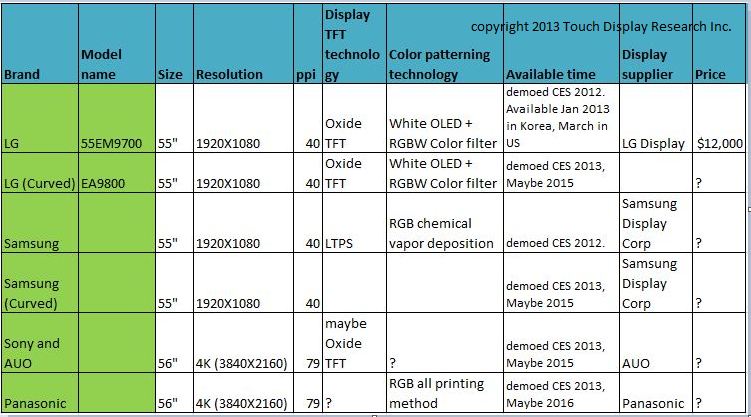

Recently, display and touch screen integration have become necessary to reduce cost, weight, and thickness. This has led display manufacturers such as AUO, Innolux (used to be named ChiMei Innolux), and CPT to grasp an opportunity and supply the new devices.

In 2013 a wave of new opportunities and challenges are approaching. Touch Display Research analyzed the growth opportunities in:

- Large smart phone (>5”)

- Touch technology for notebook and all-in-one PCs

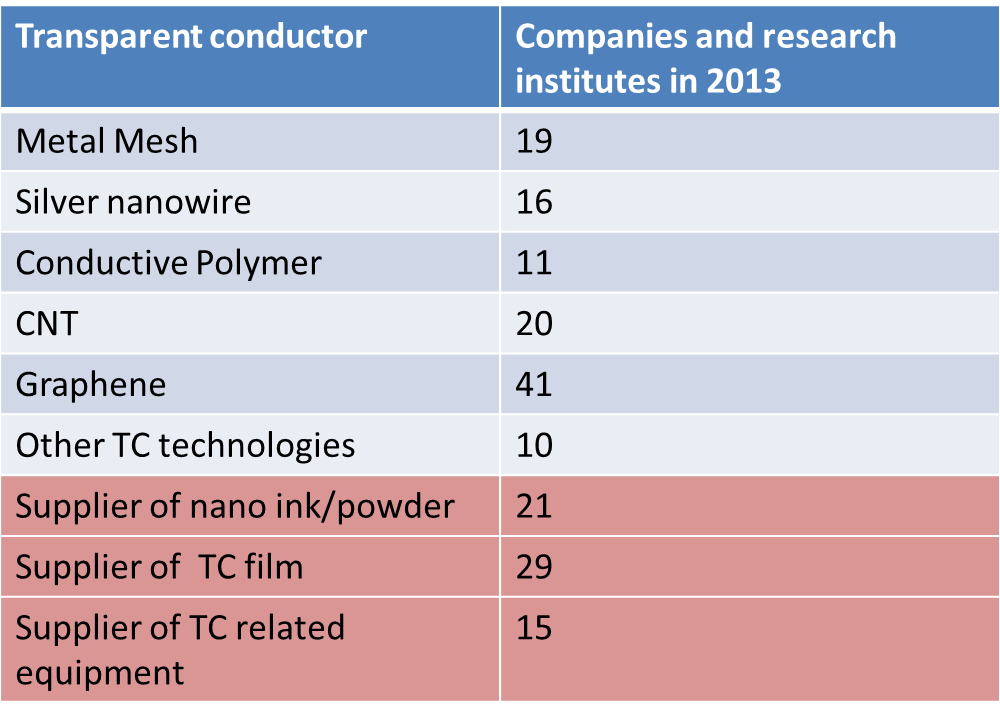

- ITO-replacement materials

- Multi-touch and simultaneous pen writing

- Touchless control

I am honored to be delivering a special forum at the conference and eager to meet Taiwan’s touch screen and display manufacturers.

Jennifer and team